Key Sections

Looking to diversify your retirement portfolio with the potential of cryptocurrencies? BitcoinIRA¹ empowers you to do just that. By offering self-directed IRAs that hold digital assets like Bitcoin, Ethereum and 60+ cryptocurrencies, BitcoinIRA unlocks a new frontier for retirement planning. This review will delve into the key features of BitcoinIRA, including its industry-leading security measures, responsive customer service, and innovative product offerings.

Fort Knox-Level Security for Your Crypto IRA²

BitcoinIRA understands the importance of safeguarding your retirement savings, especially when it comes to cryptocurrency. That’s why we leverage industry-leading security practices to keep your digital assets safe:

- Multi-Signature Wallets: Imagine needing multiple keys to open your safe. That’s the concept behind multi-signature wallets. Transactions require more than one key for approval, significantly reducing the risk of unauthorized access or theft.

- Cold Storage Fortress: A significant portion of your cryptocurrency is secured in cold storage, an offline environment isolated from online vulnerabilities. Think of it as a vault specifically designed for digital assets.

- Ironclad Encryption & Cybersecurity: BitcoinIRA utilizes advanced encryption technology to shield data transmission and storage. Additionally, we follow rigorous cybersecurity protocols to keep your information safe from cyber threats.

Beyond the Basics: Protecting Your Every Step

BitcoinIRA’s robust security measures provide a safe and secure environment for your cryptocurrency IRA. Our commitment to security goes beyond core measures. We’ve implemented additional safeguards for complete peace of mind:

- Two-Factor Authentication: An extra layer of verification during login, adding another hurdle for unauthorized access.

- Watertight Verification Protocols: We have established procedures to confirm your identity before granting access to account information.

- Scrutinized Intake Processes: Transfers and rollovers require detailed documentation, to ensure accuracy. We understand situations can vary, and we’ll work with you to verify details if needed.

- Unwavering Compliance: We strictly adhere to established procedures for handling legal documents like Power of Attorney (POA) and Guardianship documents.

Customer Service Processes

Understanding cryptocurrency and retirement planning can be difficult. That’s why BitcoinIRA offers a multi-layered support system designed to empower you at every step of your journey.

- Personalized Guidance: Connect with dedicated specialists who understand the intricacies of crypto IRAs. They’ll answer your questions and provide personalized advice tailored to your investment goals.

- Learning on Your Terms: Explore a comprehensive library of educational resources, including guides, FAQs, and webinars. Whether you’re a seasoned investor or just getting started, BitcoinIRA has the resources to equip you with knowledge.

- Responsive Support Team: Reviews consistently praise BitcoinIRA’s responsive customer service team. Our representatives are adept at handling inquiries, guiding you through complex transactions, and resolving technical difficulties efficiently.

Behind the Scenes: Ensuring Your Satisfaction

At BitcoinIRA, exceptional customer service isn’t just a promise, it’s a core principle. Here’s a glimpse into how we ensure you receive the best possible support:

- Streamlined Communication: Submitting questions is easy and secure. Our online platform allows for secure form submissions, and clearly defined channels (like [email protected]) ensure your inquiries reach the right team quickly.

- Empowered Representatives: Our customer service representatives are highly trained and possess in-depth knowledge. We invest heavily in ongoing training to ensure they’re equipped to handle any situation.

- Going the Extra Mile: We utilize specialized systems to track client requests and maintain clear communication throughout the process. Standardized procedures and checklists guarantee every request receives the attention it deserves. Quality control measures also identify and address any inactive requests, so you can be confident your questions won’t get lost in the shuffle.

Invest with Confidence, Knowing We’re Here to Support You

Product Quality

BitcoinIRA empowers you to build a retirement portfolio tailored to your goals with a diverse array of features:

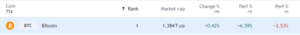

- Expand Your Horizons: Go beyond the basics of Bitcoin and Ethereum. BitcoinIRA offers a wide selection of cryptocurrencies, allowing you to diversify your holdings and potentially maximize your returns.

- Invest with Ease: The user-friendly online platform caters to both beginners and experienced investors. Intuitive tools and informative dashboards provide valuable insights to guide your investment decisions.

- Traditional or Roth? You Choose: BitcoinIRA offers both Traditional and Roth IRA options, ensuring you have the flexibility to choose the tax strategy that aligns best with your financial goals.

Other Relevant Features

Manage Your Crypto IRA on the Go: BitcoinIRA puts control at your fingertips with mobile app. Conveniently monitor your investments, track performance, and manage your account anywhere, anytime.

Invest with Confidence: BitcoinIRA prioritizes the security of your investments. Assets are insured for added peace of mind. Additionally, BitcoinIRA adheres to strict regulatory compliance. They work closely with custodians and ensure adherence to IRS regulations, guaranteeing your investments are secure and legally sound.

Conclusion: Invest in Your Future with Confidence

BitcoinIRA stands out as a secure and feature-rich platform for incorporating cryptocurrencies into your retirement strategy. Their robust security measures, responsive customer service, and diverse offerings make them a compelling choice for those seeking to diversify with digital assets. Carefully consider your financial situation and consult with a financial advisor to ensure crypto IRAs align with your long-term goals.

Here’s how to get started:

- Open an account here for a quick and easy online signup.

- Contact our top-rated customer support:

- Call us on 866-570-1947.

- Email us at [email protected]

- Schedule a call with a BitcoinIRA Specialist.

- Bitcoin IRA is a platform that connects consumers to qualified custodians, digital wallets and cryptocurrency exchanges. The company is not a custodian, is not a digital wallet and is not an exchange. The information provided in this article is for educational purposes only. We encourage you to consult an adviser or professional to determine whether Bitcoin IRA makes sense for you.

- Security, storage, wallet providers, and insurance may vary based on asset chosen and custody solution available.

3,500+ 5-Star Reviews

3,500+ 5-Star Reviews