Key Sections

The world of cryptocurrencies is booming and integrating them into your retirement plan can be an attractive option. But before you dive in with BitcoinIRA¹, the world’s first and most trusted Bitcoin IRA platform, understanding their fee structure is crucial. After all, you want to ensure BitcoinIRA aligns with your financial goals.

Beyond Transactions: A Breakdown of Value-Added Services

BitcoinIRA goes beyond just facilitating cryptocurrency trades. Here’s what their fees encompass:

- 24/7 Online Trading Platform: The convenience of buying and selling cryptocurrencies whenever the market moves.

- Mobile App with Advanced Features: Manage your IRA on the go with the BitcoinIRA app (iOS/Android). Leverage features like secure two-factor authentication (2FA) and real-time portfolio tracking.

- Industry-Leading Security²:

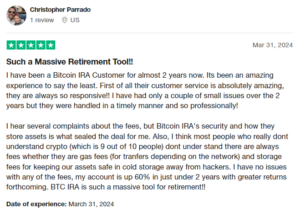

- $250 Million Insurance²: This top-tier insurance through BitGo protects your assets in case of a custodian breach, offering unparalleled peace of mind.

- Multi-Layered Security Measures: Military-grade cold storage², a partnership with BitGo and multi-signature technology contribute to BitcoinIRA’s robust security infrastructure.

- Tax-Advantaged Investing: Grow your retirement savings tax-free³ within a qualified IRA, a significant benefit for long-term wealth accumulation.

- Investment Insights and Resources: Real-time market data, performance reports, and educational materials can empower you to make informed investment decisions.

- Diverse Crypto Portfolio: Diversify your retirement holdings with access to over 60 cryptocurrencies.

- Dedicated Customer Support: Receive personalized assistance from specialists whenever you need help.

The Takeaway

Take control of your retirement and explore the potential of cryptocurrencies with BitcoinIRA’s secure and feature-rich platform. By understanding what the fees cover, and comparing it to other options, you can make an informed decision about whether BitcoinIRA aligns with your budget and long-term investment goals.

Don’t hesitate to contact BitcoinIRA directly for detailed information on their fee structure.

Ready to Get Started?

Open your BitcoinIRA account in just 3 easy steps and start trading crypto within minutes! Here’s how:

- Open an account here

- Contact their top-rated customer support team via:

- Phone: 866-570-1947

- Email: [email protected]

- Scheduling a call with a specialist.

Diversify your retirement portfolio with the most trusted Crypto IRA platform.

- Bitcoin IRA is a platform that connects consumers to qualified custodians, digital wallets and cryptocurrency exchanges. The company is not a custodian, is not a digital wallet and is not an exchange. The information provided in this article is for educational purposes only. We encourage you to consult an adviser or professional to determine whether Bitcoin IRA makes sense for you.

- Security, storage, wallet providers, and insurance may vary based on asset chosen and custody solution available.

- Some taxes may apply. We recommend you consult your tax, legal or investment advisor.

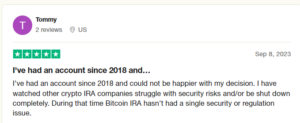

3,500+ 5-Star Reviews

3,500+ 5-Star Reviews