Tax Challenges & Opportunities of a Crypto IRA

Since the Genesis block was mined in 2009, Bitcoin and other cryptocurrencies have gained in popularity with retail and institutional investors; likely in part due to its potential for substantial returns.

It may come as a surprise that despite its $1 trillion market cap to date, only 20% of Americans own cryptocurrencies. A recent Coinbase study revealed that “67% of Americans agree that the financial system needs major changes or a complete overhaul.” With the majority of Americans unsatisfied with the current financial system, why haven’t more Americans invested in an alternative solution like crypto?

One possible reason that the average American has not invested in crypto yet is the perceived crypto tax hurdles. Despite the confusion, understanding how crypto taxes work “might be easier to do than you think.” Similar to stocks and bonds, non-IRA crypto gains generally yield a capital gains tax of up to 20% as of 2023. However, there are a number of strategies to consider that could positively affect your tax obligations, such as investing within a crypto IRA like a Bitcoin IRA.

Crypto IRA versus non-IRA crypto investing

1. Capital gains taxation

Did you know that you can avoid taxes on profitable crypto trades in a Traditional or Roth crypto IRA? BTC has seen significant growth in its brief lifespan, so you could be on the hook for significant capital gains taxes if you invest outside of an IRA.

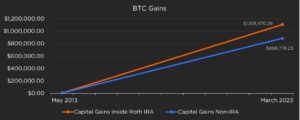

Hypothetically, if you wisely contributed the maximum amount allowed for someone 50 years or under each year until retirement, you could be looking at sizeable earnings from your initial investments within a Bitcoin IRA. Let’s say you purchased 1 Bitcoin on May 1, 2013. At that time the price of 1 whole Bitcoin was $116.75. If you then sold that Bitcoin on March 1, 2023 you would have earned $1,108,470.29.

For the average married earner you would have paid 20% capital gains tax on your $ earnings. That means that in 2023 you could have paid over $200,000 on those earnings.

However, if you used an IRA to make that same investment, you would never have to pay capital gains taxes.

Differences between Roth IRAs and Traditional IRAs

Let’s breakdown the difference between investing in a Roth versus a Traditional IRA when holding Crypto.

Roth IRAs are funded with post-tax contributions. With a Roth IRA, you may be able to avoid hefty taxes in the future because you paid the taxes up front. Withdrawals taken at retirement age are typically tax free.

Traditional IRAs are funded with pre-tax dollars, so any income made on your crypto investment will be taxed at your income tax rate upon withdrawal at retirement age.

2.Buy-sell tracking

Non-IRA crypto investing requires you to track every trade that you make and report your gains and losses to the IRS. You can imagine how tiresome it might be to report on gains and losses for every trade you make when you convert your crypto. It might even make you trade less to avoid the accounting work.

One of the benefits to crypto IRA investing is that you are not required to track your trades. You’re free to focus on “buying low and selling high” as the infamous investors saying goes. A crypto IRA allows you to re-invest your gains exponentially so that one mistake doesn’t cost you valuable time and money in the long run.

3. Unlimited tax-advantaged re-investing

That brings us to our final crypto IRA benefit. You can buy and sell your crypto assets as many times as you want within an IRA and not be taxed. Outside of an IRA, you would owe capital gains taxes on any gains from the sale or exchange of crypto. But with a crypto Roth IRA, you typically pay zero taxes when you take qualified distributions and with a crypto traditional IRA there are typically no taxes until you take distributions at retirement age. That means you can re-invest your contribution amount within your IRA and use the infamous “buy low, sell high” technique to maximize your retirement savings.

Conclusion

Self-directed crypto IRAs present growth opportunities that non-IRA crypto investing just simply cannot offer. They allow you to avoid capital gains taxation and time-consuming trade tracking so you can focus on investing.

Depending on your unique strategy, retirement goals, and the market, Traditional and Roth Crypto IRAs have the potential to boost your returns while having their own pros and cons.

If you’re ready to take advantage of Crypto IRA investing, with the added advantage of a secure and user-friendly platform, consider partnering with a reputable provider like BitcoinIRA1 . We offer a dedicated customer support team to help you navigate the idiosyncrasies of Crypto IRA investing, as well as educational content, email news updates, and more at no additional cost. Diversify your financial future and open an account today!

1.Bitcoin IRA is a platform that connects consumers to qualified custodians, digital wallets and cryptocurrency exchanges. The company is not a custodian, is not a digital wallet and is not an exchange. The information provided in this article is for educational purposes only. We encourage you to consult an adviser or professional to determine whether Bitcoin IRA makes sense for you.

3,500+ 5-Star Reviews

3,500+ 5-Star Reviews