Bitcoin has planted itself firmly back in the financial news as the digital currency is again above or near all-time highs, not seen since the crypto run faded in 2018. However, this time Bitcoin could be around to stay.

PayPal (NYSE: PYPL), Square Inc (NSDQ: SQ), and dozens of other companies recently announced they would begin accepting cryptos by the end of 2020. Not only that but cryptocurrency experts like Anthony Pompliano, AKA The Pomp, have made Bitcoin and Ethereum price predictions that show the assets could remain a bullish market.

As Bitcoin and other cryptocurrencies gain endorsements and acceptance from companies like PayPal, Microsoft, and AT&T, it’s time to evaluate their potential role in a diversified portfolio. Does Bitcoin have a place in your IRA? Should you invest in Bitcoin or invest in Ethereum? Or should you continue with only the old-school mix of stocks and bonds? A lot will depend on your own individual goals and risk tolerance, but you might be surprised to learn how far Bitcoin has come in a short time frame.

What are Stocks?

A stock is a little piece of paper that says you own a tiny stake in a public company. Stock certificates used to be sent in the mail. Today, you won’t get a certificate (or even a little piece of paper) since most trading is done electronically or over the phone. However, buying a stocks still allows you access to a portion of an operating company’s profits.

When public companies want to raise capital, they have a few options. They can issue debt in the form of bonds, which act as loans purchased by investors or institutions. Bonds are basically IOUs — you lend your capital to the company and they promise to return it at a specific future date, along with some income payments during the life of the debt (called a coupon). But bonds don’t entitle you to any profits, just the return of the money you originally lent out.

Companies can also issue equity in the form of stock to raise money. During an offering, a public company will sell off little pieces of itself as shares of stock to investors. Stocks are riskier than bonds since the company’s performance dictates how much the stock returns, unlike the preset parameters of a bond. If the company does well, the shares could balloon in value, plus investors could be rewarded with dividends on any excess profit. However, if the company struggles and sales don’t meet expectations, the value of the shares will likely decline, and investors will have no recourse for their lost capital.

Pros of Stocks

- Historical precedent: Stocks have been around for centuries and today’s public markets still contain firms that were operating back in the 1800s. Over time, stocks in the S&P 500 tend to return around 10% annually.

- Ability to diversify: Buying individual stocks can be risky, but you can still invest without ever buying an individual company’s shares. Through mutual funds and ETFs, stock investors can buy a basket of equities which prevents the risk of any single company sinking your portfolio.

Cons of Stocks

- Time horizon: If you want to get rich fast, then a diverse basket of equities likely won’t excite you. Sure, occasionally you can pick winners and losers correctly, but stocks are a long game and may disappoint if you have a short time horizon.

- Bottom of the totem pole: Should the company you invest in go under, you likely won’t be compensated for your loss. Stockholders are the last ones paid out in bankruptcy, which is why diversification is so important. That’s why diversifying in other assets is important.

- Evaluating your risk tolerance: How well would you handle a 20 percent drawdown in stocks? It’s a difficult question to answer unless you experience it firsthand. Investing can bring out a lot of emotions since our hard-earned money is involved, which makes less sophisticated stock buyers prone to panic and irrationality. If you want to trade stocks successfully, you need to be honest about your own tolerance for risk.

What is Bitcoin?

Bitcoin is a cryptocurrency developed to run through a digital ledger known as the blockchain. Developed in 2009 by Satoshi Nakamoto, the goal of Bitcoin was to provide a decentralized currency for online transactions. The idea behind cryptocurrencies wasn’t a new one, but Nakamoto was the first to offer a solution to the inherent security issues behind a non-centralized digital asset.

By utilizing blockchain technology, Bitcoin would create a ledger of transactions that was both secure and unchangeable. Each transaction would be recorded and stamped to verify its uniqueness, which would prevent Bitcoins from being manipulated or spent twice. Basically, Nakamoto’s currency would prevent digital counterfeiting without the input of a central authority.

Bitcoin transaction processing speed has been lapped by some new entrants like Ethereum and Bitcoin Cash in the cryptocurrency space. Still, Bitcoin is an intriguing high-potential growth asset worthy of discussion for your portfolio, especially in a crypto IRA or 401k.

Pros of Bitcoin

What are the pros of investing in Bitcoin?

- Scarcity: One of the biggest factors when determining the value of an asset is scarcity. This concept was widely on display during the early stages of the pandemic when the prices for N95 masks and other forms of PPE skyrocketed as demand surged and supply dwindled. When it comes to the economics of Bitcoin, when demand increases quicker than supply, prices go up.

- Inflation hedge: In years past, investors would turn to assets like gold as a store of value if they perceived inflation on the horizon. While gold and the S&P 500 certainly don’t move in lockstep, physical gold can be expensive to own and impractical to use or transport. With Bitcoin emerging as a legitimate asset, it could create a better inflation hedge than gold since Bitcoin has a maximum quantity of 21 million. That’s why some investors are choosing to invest in Bitcoin rather than gold.

- Possibly the best crypto to invest in: Hundreds of different cryptocurrencies and coins exist, but none have become synonymous with the entire asset class in the way Bitcoin has. While Bitcoin may not be the cheapest to mine or use the blockchain most efficiently, it does have the benefits of brand recognition. Plus, there are many crypto experts who have incredibly positive Bitcoin price predictions of $100k or more.

Cons of Bitcoin

- Volatility: Bitcoin is a single entity, like an individual stock or bond. When you buy stocks, you can buy ETFs to own a basket of securities and take a little of the edge off your portfolio. Not so with Bitcoin. Bitcoin can be a volatile asset, which could be scary if you’re risk-averse or investing in the short-term.

- Not widely available through brokers: Most brokers don’t have a way for their clients to access the cryptocurrency markets yet. But our Bitcoin IRA platform makes it easy for investors to buy cryptocurrencies and even gold.

Which is better: Bitcoin or Stocks?

Stocks are typically less volatile, whereas cryptocurrencies are newer and have potentially more risk and reward.

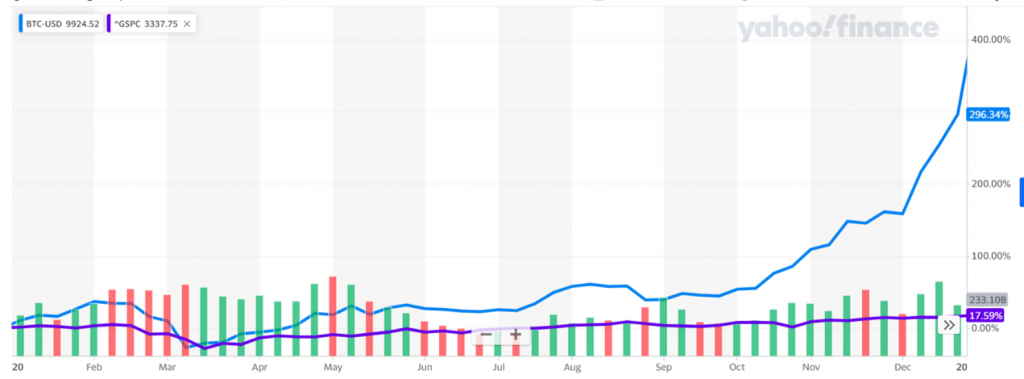

But one thing is for certain, Bitcoin has been significantly outperforming the S&P 500 in 2020 by a giant magnitude in 2020. To be more specific, the S&P 500 increased by around 18%, while Bitcoin went up nearly 350%.

Source: Yahoo Finance

Overall, these investment choices differ significantly so the decision is based on each investor’s personal preference and includes factors such as time horizons and risk appetite.

Many financial experts say it’s important to diversify your investments to decrease risk. Investing can be complicated, but online sources, such as Benzinga, CoinDesk, or Investopedia, can be one of many sources you can use to learn about investing.

Recommended article: How Bitcoin IRA works

3,500+ 5-Star Reviews

3,500+ 5-Star Reviews