September 15, 2017, the Chinese government officially issued a ban on all Bitcoin exchanges and trading platforms. The ban did not come as a surprise, rumors had been circulating for some time, but the ruling still triggered a mass exodus of investors. When rumor became reality a nervous market began selling off, sending the price of Bitcoin into a slide. The talk in the crypto-community immediately turned to whether Bitcoin was a bubble and this was the beginning of the end for the digital currency.

However, experience investors know that the price dip and setback with China are mere bumps in the road and Bitcoin’s path to growth will continue. As a proof point, by press time the price of Bitcoin had already recovered from $3,000 up to $4,011.

Here are just a few reasons and arguments from the experts as to why Bitcoin and digital currencies will be unaffected by the China exchange and ICO ruling.

Facebook and Google are Banned from China and Still Thriving

If there’s a precedent to be set about China’s ability to stifle innovation, one only need to look to companies like Facebook and Google. Both platforms can easily be characterized as giants worldwide with billions in earnings and mass adoption. What’s more, both platforms have also been banned in China.

There’s no doubt that China is a huge market, but Google and Facebook have thrived despite having no presence there.

Stelian Balta, Founder and Managing Partner of HyperChain Capital had this to say: “Digital assets can be considered commodities trading on supply and demand. There is fixed supply and increasing demand. China is an important market and the recent news of exchanges shutting down and ICO funding being banned certainly has a short term negative effect on the prices. However, digital assets are a global phenomenon. Huge Internet businesses like Facebook or Google are banned in China and are doing pretty well.”

In fact, China only accounted for 6.4 percent of global Bitcoin trades. The world of cryptocurrency is still growing and has a long way to go before it overtakes traditional currency. In short, there’s plenty of opportunity left in the digital currency marketspace.

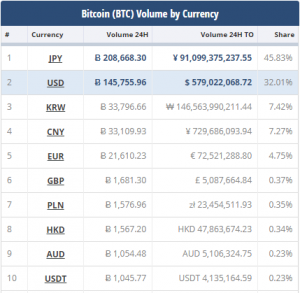

Trading Volume has Moved to Japan

Once China left the digital currency market, other countries were ready and waiting to take up the slack. Case-in-point, according to CryptoCompare, Japan became the leader in volume by currency with 50.75 percent market share of the global Bitcoin exchange market in the days after the ban. The three largest exchanges, BTCC, Huobi and OKCoin immediately moved to Japan after the ban, boosting it to the number one position. Time will tell how Japan continues to fair against the usual leaders of Korea, Europe, Great Britain, and the United States, but China’s ruling has opened up opportunity.

Some experts are even arguing that the China ban could be beneficial to the rest of the market. Litecoin creator Charlie Lee, said, “This is a good thing. China can no longer play with the markets by banning Bitcoin. Cryptocurrency cannot be killed by any country. One solution to centralized exchanges is decentralized ones.”

Bitcoin’s rebound in price post China ruling serves as proof of Lee’s statement that no single country determines the fate of digital currency. The heart of Bitcoin and other coins is decentralization. They are the people’s currency and governments will never truly be able to stomp them out.

Bitcoin Always Recovers

Tom Lee, the former JP Morgan Chief Equity Strategist and current Head of Research for Fundstrat, made an appearance on CNBC’s Fast Money about Bitcoin is still a strong investment and store of value. “I unequivocally believe bitcoin is your best investment to the end of the year.” Lee went on to say that he believes Bitcoin will be worth $25,000 in five years.

Bitcoin investors are used to these types of swings in price because one thing remains true: Bitcoin always recovers.

[mk_mini_callout title=”Free Download” button_text=”Get the Ultimate Investor’s Guide to Bitcoin IRAs” button_url=”/resources/investor-guide”][/mk_mini_callout]

3,500+ 5-Star Reviews

3,500+ 5-Star Reviews