Ethereum is prepping for a highly anticipated upgrade in November 2020.

The goal of the upgrade is to enable the chain to scale its speed to handle significantly more transactions volume to match that of Visa and other major payment processors and increase its security.

The upgrade has the potential to dramatically raise the awareness and adoption and trigger the next wave of new buyers into the space.

Ethereum Is Switching To “Proof Of Stake”

Bitcoin has a proof-of-work (PoW) method that requires “miners” to validate transactions on the chain. This is a costly, power-hungry method that’s not scalable. Proof-of-stake (PoS) serves a similar purpose of validating transactions, but it’s far more energy-efficient and enables everyday people to help validate the network using a computer as simple as their home laptop.

Essentially, proof-of-stake asks users to lock their invested Ethereum into the network. By doing so, these users become validators, which serve a similar purpose to miners, only without the need for expensive hardware, opening up the network to more people.

Bitcoin mining has become so popular that many aren’t profiting from it. While many miners are working to solve the same algorithm for each block, only the one who solves it is rewarded. This results in a massive waste of time and energy from the others who didn’t solve it in time. Plus, being first means that only those who can afford hundreds of expensive graphics cards will earn from Bitcoin, effectively locking most people out of mining. Therefore, Ethereum’s move to PoS is so exciting for investors.

ETH Holders Can Earn Up To 20% Interest with Staking

Stakers, or validators, are given the opportunity to validate incoming transactions, earning rewards in passive income or interest in crypto, based on their amount staked. The idea is that those who invest in the network are most willing to work in their best interest. It rewards those who put the most effort in and makes the path to doing so much more accessible.

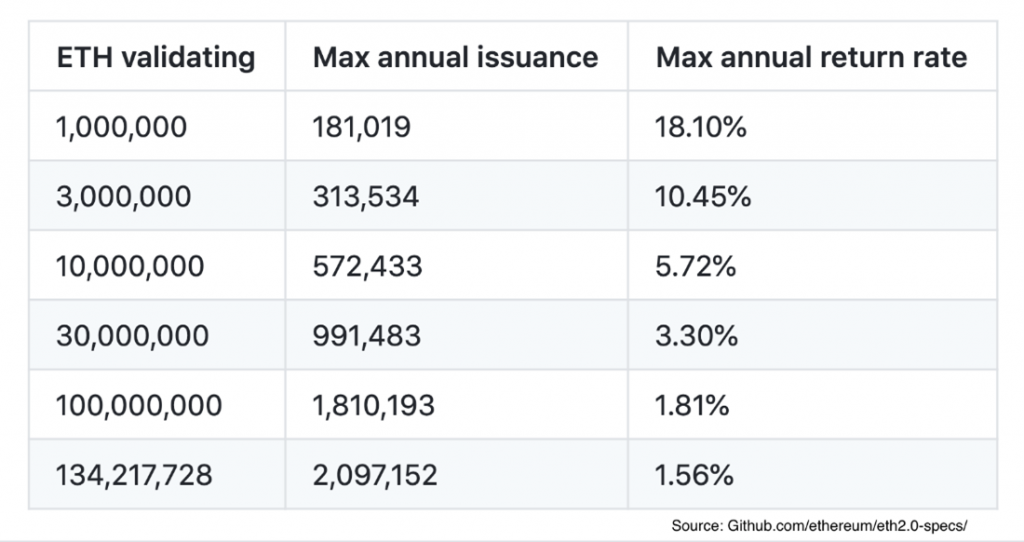

On Ethereum 2.0, users must stake a minimum of 32 ETH to become a validator. Based on the number of ETH staked on the network, validators can earn nearly 20% APY. The high yield is an incentive for more people to stake their ETH at the beginning and help secure the network. The more people that join then the lower the yield will become.

Validators who fail to act in the network’s best interest might lose that staked ETH in a process called slashing. Keep in mind that as a validator, you’re being trusted to properly run the Ethereum blockchain. This means you must leave your computer with the staked ETH connected to the Ethereum network, validating blocks and voting on upcoming changes.

Earning interest should also incentivize more users worldwide to stake and become validators, effectively decentralizing the Ethereum blockchain.

We plan to enable staking as an option for our clients soon after launch through our partner BitGo. Stay tuned for details.

Ethereum 2.0 Road Map

Ethereum 2.0 will launch over the next few years in three phases, which are described below. Essentially, Ethereum will launch a new blockchain to act as the foundation for these changes before it breaks the network down into more manageable chunks, and then making sure those chunks work. Each dApp will then get its chunk that will report to the main blockchain.

Due to the complexity of the upgrade, breaking 2.0 up into phases means it may take years for everything to fall into place. However, this is necessary for the development team to fix any bugs and make sure the features are properly in place before releasing it into the wild.

Plus, the team can’t just abandon Ethereum 1.0. Remember, the chains will exist in tandem until everyone migrates over onto 2.0, and that won’t happen until the entire feature set is in place. Breaking development into phases might not be the fastest process, but it will ensure a safe, secure one for the future of Ethereum.

Phase 0: Staking (late 2020)

The Beacon Chain will exist alongside the current PoW chain and will introduce the PoS consensus algorithm. Here, users can send their Ethereum 1.0 ETH to the Beacon Chain to become validators. Essentially, this chain is the foundation for the entire 2.0 upgrade.

Phase 1: Speed/Sharding (2021)

Phase 1 will introduce 64 shard chains that will enable Ethereum to process more than 100,000 transactions per second, equally the speed of traditional platforms like Visa and Mastercard. They are less likely to be stressed with too many transactions. Rather, the validators will commit blocks with next to no value. The idea is to make sure the shard chains work before dApps begin to utilize them for their own needs.

This will be done through crosslinks, which are defined as “a set of signatures from a committee attesting to a block in a shard chain.” These crosslinks are committed to the Beacon Chain, which is how shard chains pull information from one another.

Phase 2: Migration (2022+)

Phase 2 will see shard chains start validating actual transactions, and smart contracts will come back into the picture. This phase will introduce a new virtual machine called eWASM, which will allow each shard chain to simulate a dApp experience to ensure they’re working correctly. The PoS chain will also start supporting user accounts.

Should everything go smoothly, the Ethereum 2.0 upgrade will allow developers more control over their decentralized applications. It should also ensure the network can handle significantly more transactions than before.

How to Buy Ethereum 2.0

Ethereum is a blockchain network, not a cryptocurrency, so you can’t buy “Ethereum 2.0.” Instead, you would want to invest in ETH, the chain’s native currency (it is also known as “Ether”).

In order to buy or sell ETH, you would use the same exchanges you use today if you want to use cash or a credit card, such as the popular Coinbase exchange, and if you wanted to invest in ETH using your retirement account, you would open an account with Bitcoin IRA.

To participate in staking and earn interest on your holdings, you must own at least 32 ETH and then you’ll send those funds to a deposit address run by the Ethereum Foundation. Instructions will be provided once the network launches. We will also be offering it for your retirement account soon through our wallet provider, BitGo.

3,500+ 5-Star Reviews

3,500+ 5-Star Reviews