Ideal Portfolio Components:

With the introduction of crypto currencies and the evolution of the underlying technology, programmable assets have gained considerable recognition. Bitcoin is now being used as an integral part of portfolios owing to its unique characteristics.

The most important characteristics of any portfolio component are: non – correlation with other assets and low standard deviation. Bitcoin has shown least correlation with respect to any other asset class past year. Even on volatility front it has proven to be much stable in the recent time.

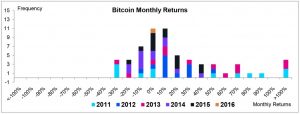

Primarily a portfolio component has to have good returns on investment. Bitcoin has fared fairly well in this respect owing to its growing adoption. Another major factor might be the inflow of funds in the face of global financial crises. Bitcoin’s monthly returns have experienced a much narrower range, evidence that the pronounced swings in bitcoin’s earliest days have begun to dissipate. This should give investors additional comfort when contemplating adding bitcoin to their portfolio.

How Bitcoin fares in Portfolios:

Illustrated below is the fictitious performance of a sample globally-allocated portfolio of stocks, bonds, commodities, and cash held over a 12-mo investment horizon. In a classic investor’s portfolio, a larger allocation is to stocks and a smaller allocation to cash, the return of this base portfolio would have been -6.9%. In our low-rate and slow-growth environment, investors have been looking to alternative assets to boost returns. An alternative asset that can be considered is Bitcoin.

Return of sample portfolios with investment horizon of 1/29/2015-1/29/2016. Base portfolio allocation indexed on: 45% S&P 500 Index, 10% MSCI Emerging Market Index, 35% Barclays Capital Bond Global Index, 5% Bloomberg Broad Commodity Index, and 5% 3-mo Treasury Bill Index (proxy for Cash). The Bitcoin-allocated portfolio indexed on 45% S&P 500 Index, 10% MSCI Emerging Markets Index, 35% Barclays Capital Bond Global Index, 2.5% Bloomberg Broad Commodity Index, and 5% 3-mo Treasury Bill Index (proxy for Cash), and 2.5% Bloomberg Bitcoin Index. Source: Bloomberg, Grayscale

Given the low correlation to other assets, and decreasing volatility, investing in bitcoin could help boost gains, while adding minimal risk to one’s overall portfolio. When we reallocate a portion of commodities into bitcoin within the aforementioned base portfolio, the total performance improves by about 2.3%, with the portfolio only returning -4.6%. The portfolio’s risk remains fairly similar as measured by the portfolio’s annual standard deviation. This illustrates the value in adding bitcoin to enhance returns, without necessarily taking on additional risk.

While we are still in the early days of this asset’s journey, the potential upside of Bitcoin is promising. As the technology to accommodate and incorporate this currency develops, we can see better and stable price levels. This disruptive technology can indeed revolutionize the way we look at financial markets and set up a digital economic system.

3,500+ 5-Star Reviews

3,500+ 5-Star Reviews