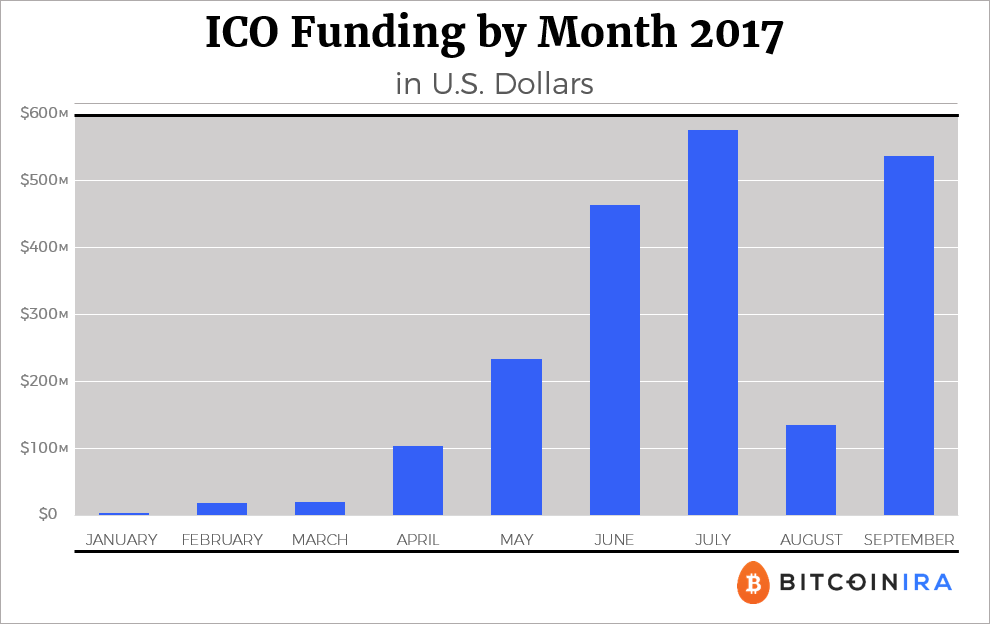

It has been one initial coin offering (ICO) breaking a record after another. Author and investor William Mougayar estimates that in June, early stage internet related start-ups raised $601 million capital from ICOs. That is $51 million more than what traditional venture capital provided in the same month.

Mougayar has become some kind of expert in ICO especially after he organized the 2017 New York Token summit in May. The event dedicated to ICOs attracted a large turnout from entrepreneurs, developers and investors. Several start-ups that have benefited from token crowdsales exhibited their projects.

The trend of record setting in ICO crowdsales will only accelerate in July with the largest ICO ever witnessed in the month. The following is a list of the five largest ICOs of 2017 so far starting with the highest.

- Filecoin – $250 Million (and counting)

Filecoin is blockchain data storage network that launched on August 10, 2017. Filecoin will use peer-to-peer InterPlanetary File System, or IPFS, to store and secure data, which will allow users to earn by donating their free hard drive storage space. Its only competition will be MaidSafe, another decentralized storage project. Filecoin raised $200 million from accredited investors and another $52 from venture capital firms. As of August 21, over $250 million in funds had been raised. - Tezos – $232 Million

Tezos is a new a blockchain that fixes the governance issues that blockchains like bitcoin face. Instead of relying on off-chain debates, compromises and consensus to improve, scale or change the core software, Tezos has self-governance mechanism built into the protocol.The Tezos ICO launched on July 1. At the end of the 14-days sale period, the project had raised about $222 million in bitcoin and ether. That became the new ICO record. - EOS – $183 Million (and rising)

Block.one is a start-up building a blockchain that meets the specific needs of the businesses and companies in the corporate world. It plans to provide blockchain solutions that offer efficiency, security and data integrity. The start-up carried out its ICO in June to support the project development. Its EOS tokens raised $183 million. That held the record until Tezos overtook it three weeks later. - Bancor – $153 Million

As more cryptocurrencies and tokens get into the crypto market, the need to transact and move value from one to another is growing. While current cryptocurrency and token exchanges facilitate the process, their centralized nature expose users to insecurity and don’t support all the tokens out there. Bancor seeks to build a decentralized exchange ecosystem that will enable holders of digital assets to trade peer-to-peer with ease and with little risk to the security of their assets. It will also support any token that is issued regardless of the number of users. Its June ICO raised $153 million. - Status – $108 Million

Status is a browser, wallet and a messenger app. It is also a gateway to decentralized applications that are built on top of Ethereum. The Status app will be available for mobile to enable on-the-go use. The team behind Status held an ICO on June 20th and raise $95 million. With more start-ups choosing ICO and the public’s interest growing, at least some of the ICOs in this list might end up not being in the top five of the biggest ICOs in 2017. Even companies that have had little to do with blockchain until recently are now interested in ICO. For instance, the messaging App Kik has released a whitepaper explaining its plan to hold an ICO.

As ICOs continue to boom so does the market value of cryptocurrency. Bitcoin’s price is on the rise, along with other altcoins such as Ethereum, Ripple, and Litecoin. If you are ready to invest in crypto with your IRA, get started here.

[mk_mini_callout title=”Free Download” button_text=”Get the Ultimate Investor’s Guide to Bitcoin IRAs” button_url=”/resources/investor-guide”][/mk_mini_callout]

3,500+ 5-Star Reviews

3,500+ 5-Star Reviews