Owning a self directed IRA, very simply put, means that you get to decide how you invest your money. Most experts agree that this is the best type of IRA to choose if you want to invest in the popular new digital currency, Bitcoin. But what is a self directed Bitcoin IRA, how does it work and what are its benefits?

What Is a Self Directed Bitcoin IRA?

“A self-directed IRA is an individual retirement account with its investments under the complete control of the investor. These types of accounts hold the same types of limitations when it comes to the amount of deposit per year and the withdrawal of funds”.

What Can You Invest In?

Although this type of IRA is self directed, which means you control what you invest in, there are some limitations that you have to understand. This is because the Internal Revenue Service has some pretty strict rules in terms of what is and isn’t acceptable.

“In order to invest in digital currency via a Bitcoin IRA, the user should ensure that their asset meets the fitness requirements set by the Internal Revenue Service (IRS). The regulations pertaining to investing in Bitcoin can be found on the IRS Virtual Currency Guidance page.”

If you do not meet these regulations, then you will have to pay certain taxes over your investment. Bitcoin is acceptable digital currency. In addition, there are regulations on how the bitcoin is stored and what access a user has to it. As such, as liberal as a self directed Bitcoin IRA may seem, it is actually quite restrictive.

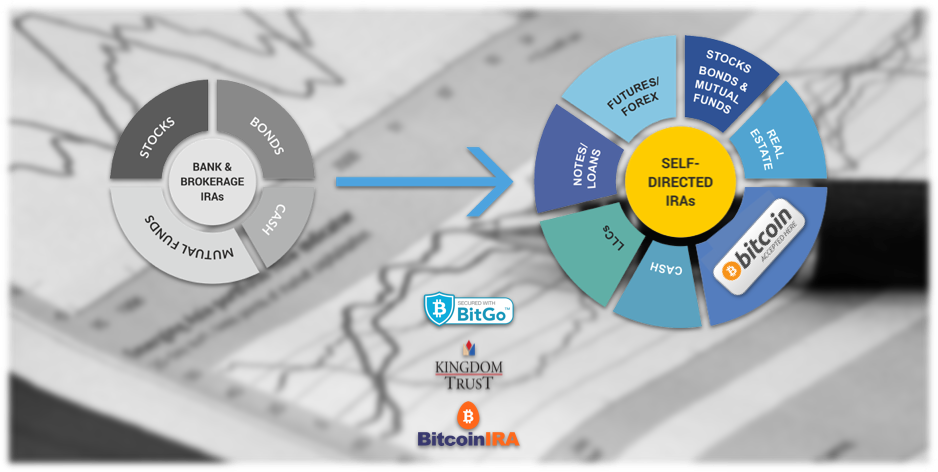

However, Bitcoin IRA has partnered with BitGo and Kingdom Trust and have been able to create the first Bitcoin IRA in America which follows the correct IRS rules themselves, which means you don’t have to worry too much about buying the wrong thing. Always try to rollover with the most trusted and reputable company, like Bitcoin IRA. They have teamed up with BitGo for extra security.

You Can Have Great Benefits

There are many different benefits of choosing a Bitcoin IRA.

“You can diversify your traditional IRA or Roth IRA by placing bitcoin in it. More importantly, you may transfer your existing IRA to a qualified Bitcoin IRA without incurring taxes or penalties. If your 401K plan permits it, you can even place Bitcoin in it.”

Having a balanced and diverse portfolio is key to having a successful investment. However, the self directed Bitcoin IRA takes that one step further. After all, you can have a diverse portfolio by investing in stocks, gold and bonds as well. What makes Bitcoin different is that you can cash out your investment at the end of your term and decide whether you want that in actual money, or in Bitcoin itself. If you opt for physical posession, you can choose to hold your Bitcoin and sell it at a later stage, when it is perhaps worth more. This means that these types of IRAs are far more flexible than any other kind. Also, Bitcoin IRAs have tax benefits.

How to Set It Up

In order to set up a self directed Bitcoin IRA, you first must find a broker that allows for these types of constructions. Bitcoin IRA is one the few for you to choose from, but do take the time to review all the various pros and cons of each plan. Many of these companies also allow you to roll over your existing IRA or 401(k), so if this is something you are considering, you can narrow down your options. Make sure to do your research and consult with a financial adviser before making any decision.

Request our FREE Bitcoin Guide Today.

3,500+ 5-Star Reviews

3,500+ 5-Star Reviews