Key Sections

The Takeaway

- Lump Sum can outperform if you invest before a bull run, but you risk bad timing if the market falls right after your entry.

- DCA smooths out those risks by spreading purchases across many market conditions.

Timing vs Consistency in Crypto Investing

Everyone dreams of catching the perfect dip, that golden moment to buy low and sell high. But in practice, timing the market is more like chasing shadows. Especially in the dynamic world of Bitcoin, where even seasoned traders can get burned.

To explore how different approaches can play out, we compared two commonly discussed strategies for Bitcoin investing over a 4-year historical period:

- Annual Lump Sum: Investing $6,000 every April 1, from 2021 to 2024

- Dollar-Cost Averaging (DCA): Investing $500 monthly from April 2021 through March 2025.

In both cases, the total investment came to $24,000. But the results told a very different story.

Let’s break this down:

- Annual Lump Sum: Contribute the $6,000 IRA maximum on April 1st of each year (2021–2024).

| Year | April 1 Open Price (USD) | Contribution | BTC Bought |

|---|---|---|---|

| 2021 | $58,926.56 | $6,000 | 0.102 BTC |

| 2022 | $45,554.16 | $6,000 | 0.132 BTC |

| 2023 | $28,473.33 | $6,000 | 0.211 BTC |

| 2024 | $71,333.48 | $6,000 | 0.084 BTC |

| Total | — | $24,000 | 0.528 BTC |

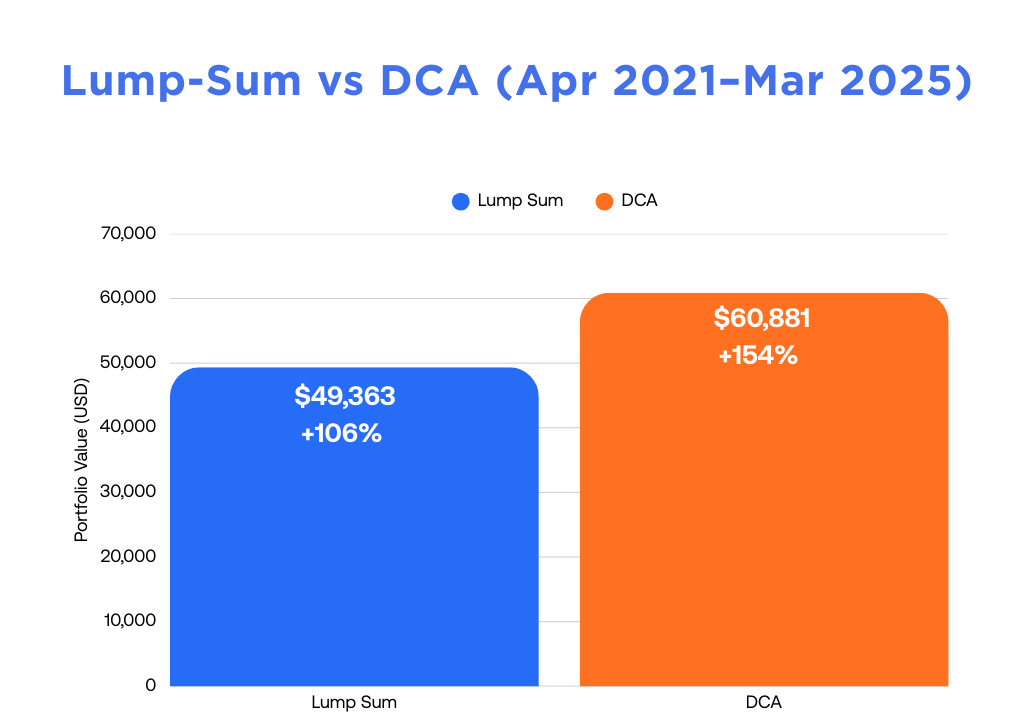

With Bitcoin trading at $93,425 in March 2025, the lump sum investment would have grown to approximately $49,363.

- Dollar-Cost Averaging: By spreading the same $24,000 into $500 monthly contributions over 48 months (using each month’s opening price), you would have accumulated about 0.652 BTC. At the same March 2025 price of $93,425 per Bitcoin, that portfolio would be worth roughly $60,881.

The Results

By March 2025 (Bitcoin price at $93,425):

- Annual Lump Sum (April 2021–2024): grew to about $49,363 (~+106% gain).

- DCA (April 2021–March 2025): grew to about $60,881 (~+154% gain).

Both investors contributed the same $24,000, but the DCA investor accumulated more Bitcoin overall and ended with a higher portfolio value.

Why Did DCA Appear to Perform Better in This Example?

In this historical example, the April 2021 (~$59K), April 2022 (~$45K), and April 2024 (~$71K) entry points were relatively high compared to other periods. As a result, each annual contribution purchased fewer Bitcoin than during lower-priced months.

By contrast, spreading contributions out monthly meant that purchases also occurred during lower price periods, such as in 2022 (sub-$20K) and early 2023 (around $16K–$23K). This reduced the average entry price and, in this case, resulted in more Bitcoin accumulated overall.

Dollar-cost averaging in this example benefited from price swings, since contributions captured both higher and lower market levels. Rather than relying on a single entry point, the approach reflected a broader range of market conditions.

For individuals focused on retirement accounts, one potential advantage of dollar-cost averaging is that it encourages consistency. Making contributions on a regular schedule can help investors avoid the challenge of trying to time the market and instead focus on steady, long-term participation.

Why Timing the Market Is Challenging

Market timing sounds tempting. But in reality, even professional traders struggle to consistently buy at the lowest lows and sell at the highest highs.

Many short-term investors react based on headlines, social media hype, or gut feelings, all of which can lead to poor decisions. In crypto, missing just a few key days of market rallies can dramatically reduce your total return.

As JP Morgan puts it, “time in the market is more important than timing the market.”

The Power of DCA: Discipline Over Drama

Dollar-Cost Averaging isn’t flashy. But it’s consistent, simple, and effective, especially in high-dynamic assets like Bitcoin.

Here’s why DCA works so well:

- Reduces emotional investing: Regular contributions can help reduce the tendency to react to short-term market movements or hype.

- Smooths out volatility: Contributions occur at both higher and lower price points, which spreads out entry levels over time.

- Providing structure: A set schedule for contributions may help maintain a disciplined approach.

In the 4-year historical example presented, DCA accumulated more Bitcoin than lump sum investing because contributions took place across both high and low price periods. While results will always depend on future market conditions, this case illustrates how a steady approach can offer a different experience compared to single-entry investing.

A Long-Term Strategy that Works

In the historical 4-year example reviewed here, making regular contributions of $500 a month resulted in a higher Bitcoin balance than investing the same amount through lump sums. While past results do not guarantee future performance, the illustration highlights how different strategies can produce different outcomes depending on market conditions.

The broader takeaway is that long-term approaches often emphasize time, consistency, and patience rather than perfect market timing.

Here’s the bonus: it’s not just about growing your wealth, it’s about keeping more of it. By holding your long-term Bitcoin investments in a Crypto IRA, you can combine the growth power of Bitcoin and an investment strategy that’s right for you to maximize your returns in a tax-advantaged account.

Ready to start? Open a BitcoinIRA¹ account today and take control of your financial future with confidence.

FAQs

What is Dollar-Cost Averaging?

DCA is an investment strategy where you invest a fixed amount on a regular schedule, regardless of market price. This helps reduce the impact of volatility and emotional decision-making.

Is Lump Sum ever better than DCA?

If the market rises steadily after a lump sum investment, that approach may outperform DCA. However, in other scenarios, spreading contributions over time can result in different outcomes. The relative performance of either strategy depends on market conditions.

How much should I invest in BTC with DCA?

There is no single “right” amount. Contributions often depend on each individual’s financial situation, risk tolerance, and investment preferences.

Can I use DCA in a Bitcoin IRA?

Yes, many providers, including BitcoinIRA, allow recurring contributions. This makes it possible to apply a DCA-style approach within a retirement-focused account.

3,500+ 5-Star Reviews

3,500+ 5-Star Reviews