The Problem With Ethereum 1.0

Ethereum currently uses a proof-of-work (PoW) system that is considered slow, relatively expensive for transactions, and highly inefficient, requiring powerful computers to solve complex algorithms to validate transactions.

PoW requires miners, who use their specialized computers to race to solve an equation to confirm transactions. The winners are rewarded in Ether (ETH), Ethereum’s currency, for being the first to find that number. However, if hundreds of miners contribute to one block, only that first one receives a reward. Thus, the rest have just consumed an enormous amount of energy to run their computers that was ultimately wasted. It’s not profitable for many, and the time it takes to find such a number causes network congestion.

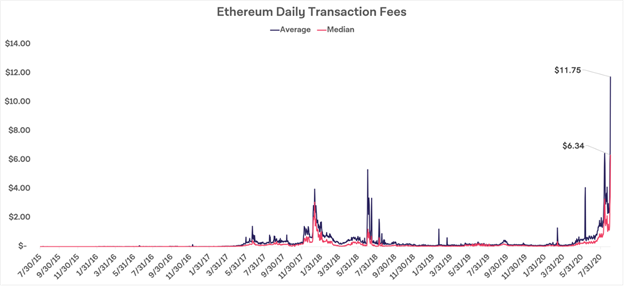

Ethereum’s network is also extremely popular causing its usage and transaction fees to spike incredibly high due to a growing number of successful applications built on it, including DeFi, gaming, stable coins, and more.

Source: The Block Crypto

Essentially, Ethereum needs a solution to scale its network, increase its security, and reduce its reliance on highly inefficient (and wasteful) computing power.

Recommended article: Investing in Ethereum

What Is Ethereum 2.0?

Such an upgrade is significant for Ethereum investors, as many believe the move will boost the asset’s price while giving investors a new way to earn money, through staking.

Some experts, like investor Adam Cochran, predict retail investors will flock to Ethereum at the prospect of passive money. After all, the earlier one becomes a validator, the higher the rewards until more validators come in and even the network out.

There’s also the predicted growth of the decentralized finance (DeFi) market. Considering the proof-of-stake consensus algorithm means faster validation thanks to the validators, this also means the network can properly scale in a way it couldn’t on a proof-of-work blockchain.

Scalability means the network can support additional users and transactions that originally would have congested it. For the first year, validators are expected to earn around 14.12% interest annually.

For Bitcoin IRA customers, if you’re holding your Ethereum in an IRA you will be able to participate in Staking soon. In the future, you may also be able to earn interest on your holdings through our interest-earning program (via lending).

Ethereum 2.0 is still a few years away, but of all the cryptos to invest in, this one is on its way to becoming the most appealing for Ethereum investors. The move to proof-of-stake is a huge improvement, and it’s one that is putting its users first.

Recommended article: Ethereum Staking

3,500+ 5-Star Reviews

3,500+ 5-Star Reviews