Key Sections

The Bitcoinverse is electrified by the impending halving, but this time, the script has been flipped. The arrival of spot Bitcoin ETFs in the US have disrupted historical narratives, leaving investors to navigate a thrilling new frontier.

Traditionally, halvings have heralded price surges. The inaugural 2012 halving, slashing rewards from 50 BTC to 25 BTC, ignited an 8,358% price explosion within a year! Subsequent halvings in 2016 and 2020 echoed this trend, albeit with diminishing returns. These historical rallies illuminate the power of reduced supply on market price, especially when demand remains steady or climbs.

The ETF Enigma: Will it Fuel the Halving Fire or Douse the Flames?

The arrival of spot Bitcoin ETFs in the US has injected a dose of uncertainty into the upcoming halving. These exchange-traded funds offer traditional investors a familiar way to own Bitcoin. But will they act as a catalyst, flooding the market with fresh capital and propelling prices upwards? Or will they simply mirror existing ownership, creating a wash of existing coins with minimal impact?

Traditionally, halvings have reduced miner income, potentially leading to increased selling pressure as they offload coins to cover costs. However, the influx of capital via ETFs could counterbalance this. By providing a steady stream of demand, ETFs could absorb much of the selling pressure from miners, mitigating the risk of post-halving price drops.

A New Landscape: Halving in the Era of ETFs

The 2024 halving differs significantly from its predecessors due to the introduction of spot Bitcoin ETFs. These instruments represent a major shift in market dynamics, allowing a broader investor base to participate in Bitcoin without the complexities of direct ownership.

Bitcoin’s current production rate is around 900 coins per day. However, this pales in comparison to the recent buying spree by spot Bitcoin ETFs in the US. In the first month alone, these ETFs acquired a staggering amount, exceeding ten times the total Bitcoin production during that period.

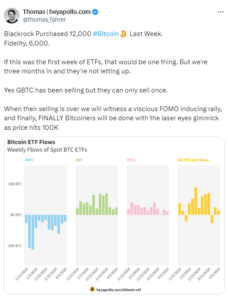

To illustrate the scale further, consider just the activity of two major ETF issuers, BlackRock and Fidelity, in the first week of April. Their combined purchases of 18,000 Bitcoins surpassed double the total Bitcoin production for that week. This aggressive accumulation by ETFs highlights the potential impact they may have on Bitcoin’s price dynamics, particularly in the context of the upcoming halving.

The upcoming halving, where miner rewards are slashed by half, will further reduce daily production. However, this doesn’t tell the whole story.

As mentioned before, demand is outpacing supply at an unprecedented rate. This is due to a surge in Bitcoin acquisition through various channels, including spot Bitcoin ETFs. Notably, these ETFs have already accumulated a significant amount, exceeding typical daily production.

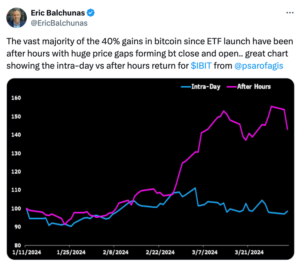

This dynamic flips the script on historical trends. Traditionally, price increases followed the halving event due to a sudden drop in supply. This time, with demand already outpacing pre-halving production, the price of Bitcoin has already climbed higher than in previous cycles.

In essence, the arrival of Bitcoin ETFs has disrupted the normal halving cycle, potentially impacting price movements pre- and post-halving.

The Post-Halving Price Conundrum: Bull Run or Bust?

The upcoming halving presents a fascinating question: will it ignite a historic bull run, or has the party already begun?

- Bullish Outlook: Optimists believe the halving, combined with the influx of ETF capital, will inevitably propel Bitcoin prices significantly higher, exceeding even current record highs.

- Skeptical View: Others hold a more cautious stance, suggesting that the market has already priced in the halving anticipation, with current prices reflecting this expectation. They believe the halving might not have the same dramatic price-boosting effect seen in the past.

While predicting the future is impossible, historical data offers some insights. Past halvings have often been followed by price corrections in the short term, with a significant price surge typically occurring around a year later. However, the unprecedented introduction of ETFs injects a layer of uncertainty into the equation.

Only time will tell how the interplay between ETFs, the halving, and broader market forces will shape Bitcoin’s price trajectory.

Uncharted Territory for Bitcoin: A Brave New World

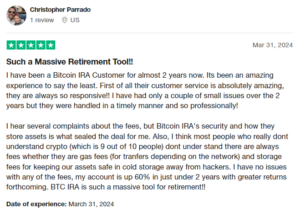

While the future remains unwritten, the upcoming halving coupled with the arrival of Bitcoin ETFs paints an exciting picture for crypto investors. This confluence of events presents a unique opportunity to potentially capitalize on significant price movements. BitcoinIRA1 provide a perfect platform to participate in this potential growth while maximizing your returns through tax advantages.

By opening a BitcoinIRA account, you can invest in Bitcoin for your retirement using pre-tax or tax-deferred dollars, allowing your crypto holdings to grow tax-free until withdrawal. This significantly boosts your long-term gains compared to a traditional investment account.

Don’t miss out on this thrilling chapter in the Bitcoin story – explore BitcoinIRA and start building your tax-advantaged crypto portfolio today!

Here’s how to get started:

- Open an account here for a quick and easy online signup.

- Contact our top-rated customer support:

- Call us on 866-570-1947.

- Email us at [email protected]

- Schedule a call with a BitcoinIRA Specialist.

- Bitcoin IRA is a platform that connects consumers to qualified custodians, digital wallets and cryptocurrency exchanges. The company is not a custodian, is not a digital wallet and is not an exchange. The information provided in this article is for educational purposes only. We encourage you to consult an adviser or professional to determine whether Bitcoin IRA makes sense for you.

3,500+ 5-Star Reviews

3,500+ 5-Star Reviews